Products / Unified Money Movement

Products / Unified Money Movement

Payments and transfers for financial institutions

Our suite of unified payments applications offers a fully integrated, customizable money movement solution that facilitates the fast and simple delivery of modern payment experiences to your consumers based on your existing systems

Money movement experiences, modern customers demand

Seamlessly deliver modern, frictionless digital payments and money movement experiences that compete with today’s most innovative digital wallet services and challenger banks.

Simple integration into existing systems

Pre-built connectors into existing digital banking, risk, and core systems quickly deliver our money movement services without major changes to your current infrastructure or expensive upfront costs.

Unified solution for a single source of truth

We break down traditional payment siloes to offer a unified solution that provides operational efficiency, a better user experience, and improved visibility across payment rail performance, cash flow, and liquidity.

Our flagship solutions

Electronic Bill Presentment & Payment (EBPP)

Deliver e-bills seamlessly and accept bill or loan payments from users with easy access to the payment channels, payment methods, and payment options they demand.

- Accelerate receivables

- Reduce operating costs

- Improve customer satisfaction and retention

Payment Channels

Mobile

Web

IVR

Agent

Walk-In

FB Messenger

Payment Methods

ACH

Credit (where

permitted)

Debit

Cash

Check

Apple Pay/Google

Payment Options

One-Time

Recurring

AutoPay

Orbipay EBPP is a fully configurable, bespoke billing and payment solution that’s tailored to your business and needs. More options, better payment experiences.

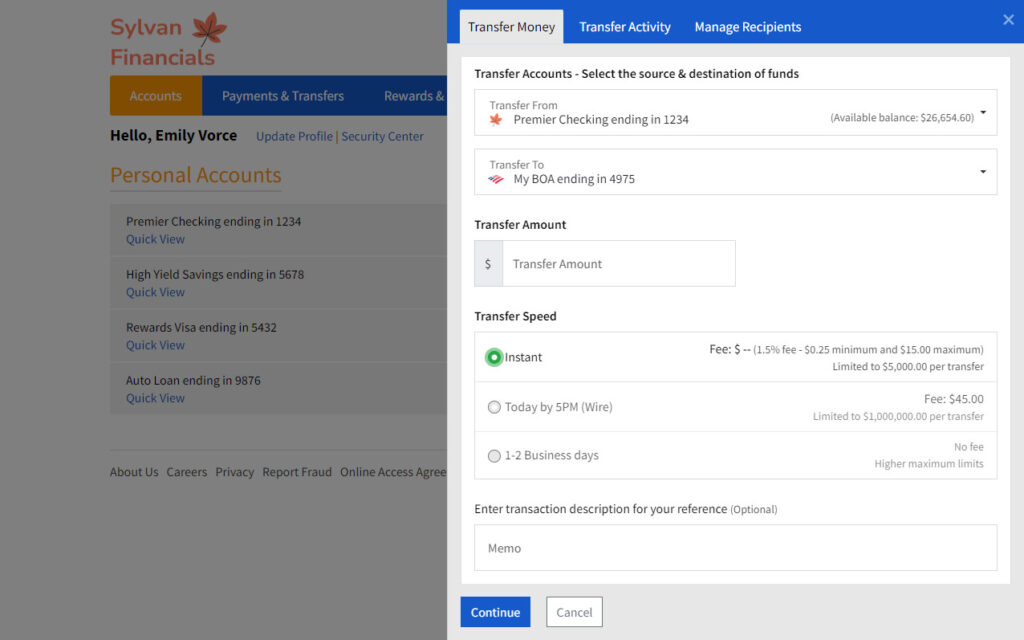

Transfers A2A

Enable consumers and businesses to move money instantly and securely between their bank accounts, regardless of what financial institution holds them.

Generate revenue through transaction fees

Enhance operational efficiency by reducing manual processes

Create convenient and seamless customer experiences that drive retention and satisfaction

Enhance operational efficiency by reducing manual processes

Create convenient and seamless customer experiences that drive retention and satisfaction

Access to Faster Payment Rails:

TCH’s RTP® network

FedNow Service

Visa Direct

Payouts

Initiate digital disbursements to payees directly, delivering a secure, streamlined payout process that puts the customer first.

Payment Scenarios

Straight-Through, One-Off, and Recurring Disbursements

Payee Portal

Payees can enroll, provide bank account information, and access payout history

Payer Portal

Customer-facing staff can access payees’ profiles, payout history, and upcoming payouts

Reporting

Quickly access reports related to payees’ historic and upcoming payouts

Alerts and Notifications

Payout-related alerts and notifications via email and/or SMS

Improve customer experience and satisfaction

Improve operational efficiency

Reduce time and costs associated with paper checks

Requests for Pay (RfP)

Send digital payment requests to your customers, allowing them to review and respond with options for payment approval, modification, rejection, or delay, all in real time.

Businesses use for RfP

Bill pay

Wallet funding

E-commerce

Person-to-person (P2P) payments

Point-of-sale payments

Pay by text

With the two-step payment validation process, you have guaranteed good funding.

Increased payment flexibility and control for customers

Improved efficiency in the payment process

Enhanced transparency in transaction details

Case Study